Payslips

Your payslips are always at hand. You can check your income limits and details anytime directly in the app. The “Payslips” feature is intended for personal use by employees.

Payslips are displayed in the employees’ user interface immediately after approval. Users can monitor income limits through the app, and the system will automatically send an alert if limits are exceeded. Payslips can be conveniently downloaded in PDF format for archiving either via the mobile or browser application.

No matter your role, you only see your own payslips here. Payroll processors can view employee payslips under the “Payment” section.

Where to find your payslip

You can find your payslips in the browser application under “Payslips” in the main menu.

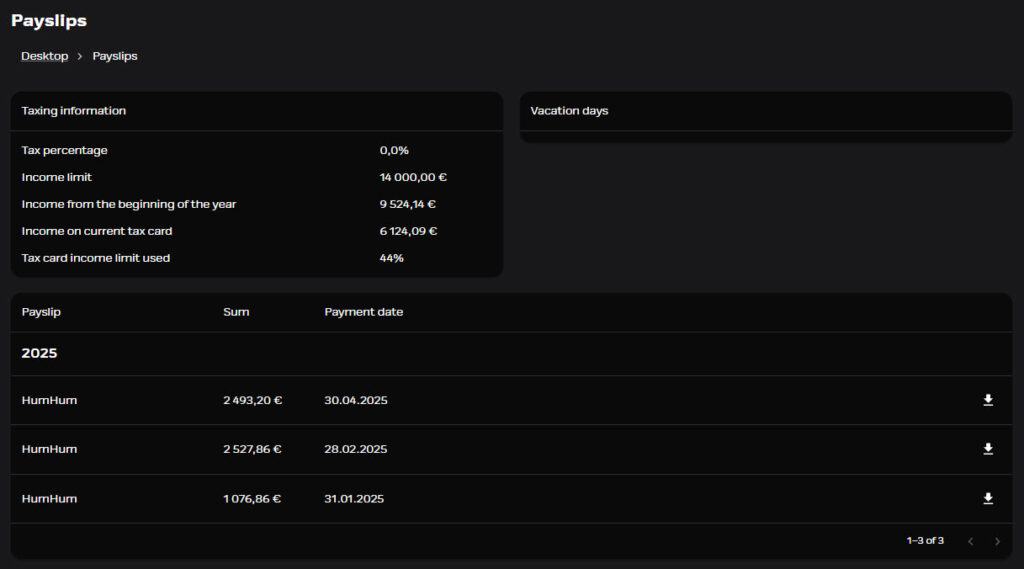

Tax information

- In addition to your payslips, you can see the base rate and income limit of your valid tax card, as well as accumulated earnings from the beginning of the year.

- Please note that the accumulated earnings figure is counted from the start of the year and does not reset when the tax card changes.

Accumulated leave

- In this section, you can check how many leave days you’ve earned and have left from the previous leave year, plus any other balances shown on your payslip.

Payslips

- This section displays a list of payslips by year and month.

- You can see the net salary paid based on the payslip and the salary payment date.

- Click on a payslip to view its detailed information.

- You can also download the payslip using the download button located on the right side.

Reading instructions for the payslip

- The “Pay Period” shows the time frame for which the salary is paid.

- The “Payment Date” indicates the day the salary was paid.

- Under “Amount Paid”, you can see the net salary paid on the payment date.

- In this section, you can see all the instalments paid in addition to the monthly/hourly salary by salary type, e.g., bonuses, allowances, and holiday pay.

- Here you can also see the deductions made from your salary. In addition to withholding tax, earnings-related pension contributions and unemployment insurance contributions, deductions may include union fees, garnishments, and other deductions (e.g., equipment purchases or lunch deductions).

- Here you can see the accumulation of different payments for the current pay period.

- Here you can see your total earnings since the beginning of the year.

If your employer’s payslip contains information from the previous year, these details are also available in the application.

- Here you can see the tax rates and income limit of your current tax card.

- Here you can see your personal identification number used in the payroll system, the start date of your employment, your bank account details, and your job title.

- Here you can see your personal identification number used in the payroll system, the start date of your employment, your bank account details, and your job title.

- Your current available vacation days are shown here with possible part-time percentagHere you can see your remaining leave days (if they are set to be visible on the payslip).

- You can also see your part-time percentage and weekly working hours.

- Basic information about your employer.

Salary slip notifications

When a user receives a new payslip, they will receive an automatic notification. Depending on the user’s notification settings, the notification will be sent either through the app as a push notification or via email.

If applicable, the same message will also include an income limit alert identified by the app’s automation.

Income limit alert

The income limit alert sent to the user takes into account the length of the pay period, earnings subject to withholding tax, earnings for the current pay period, the income limit specified on the tax card, and, based on these, the number of corresponding periods after which the income limit would be exceeded. If it appears that the income limit may be exceeded, a note will be included in the notification for the new payslip.

- Income limit alerts are sent from August onwards

- No alerts are sent in December, as the tax year is nearing its end.

- Alerts are disabled during the early months of the year.

Archiving payslip

Access to your personal payslips is maintained throughout the duration of your employment. You can download payslips in PDF format for your records.

Old payslips are automatically deleted from the system once their retention period expires. In this way, the amount of personal data stored is minimized when there is no longer a basis for storing the payslips.

- Rejected payslips are deleted after 30 days.

- Approved payslips are deleted after 2 years.

- Payslips that have been created and are pending approval are deleted after 90 days.

Did not find what you were looking for?

You didn’t find solution from our knowledge bank? You can send a message to our customer service or get in touch with our specialists.