Payslips

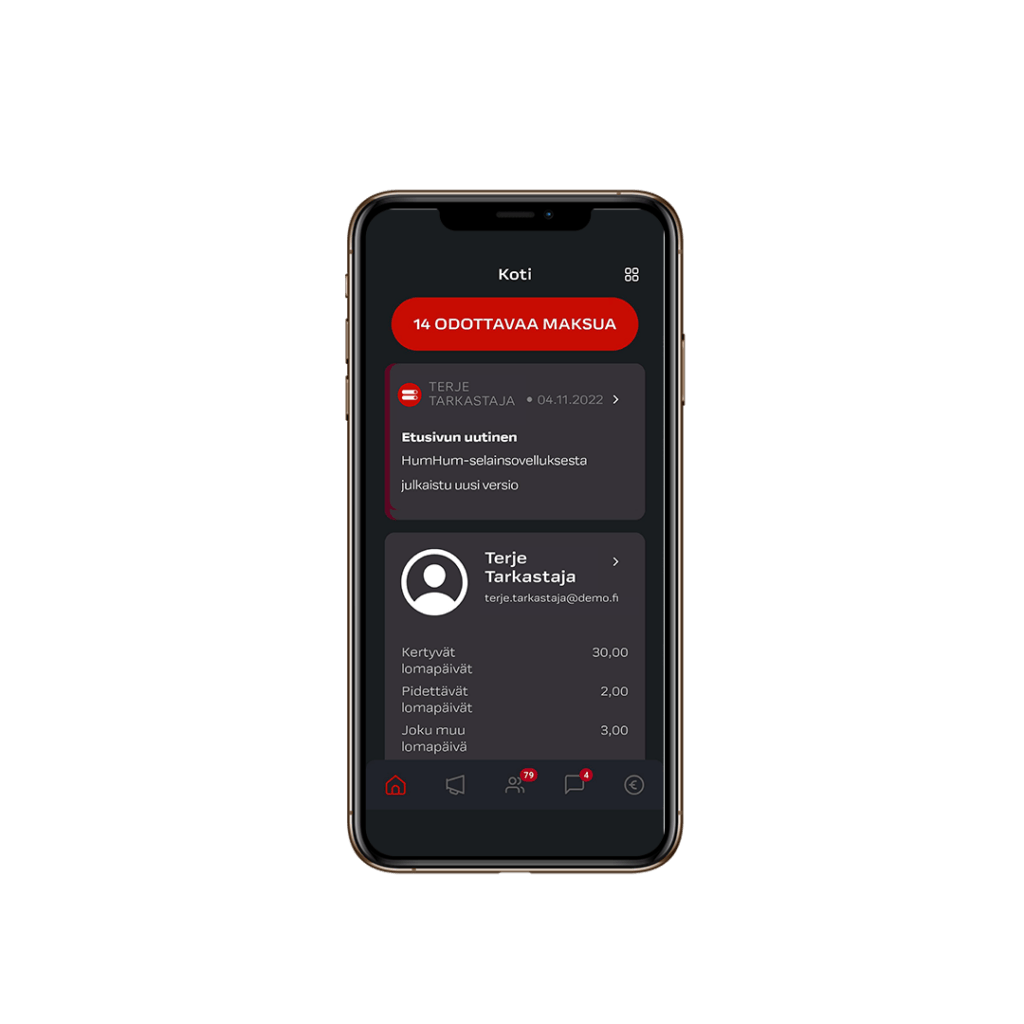

Payslips in mobile

Personal payslip is easily accessible in the Integrata® mobile app. You will receive notifications if a new payslip has arrived and it can be downloaded for safe keeping.

If the payslip functionality is implemented, users can decide whether to access their payslip throug the mobile app or web interface. Both will hold the same information.

- User can choose the method of notifications: either push-notifications through app or email messages.

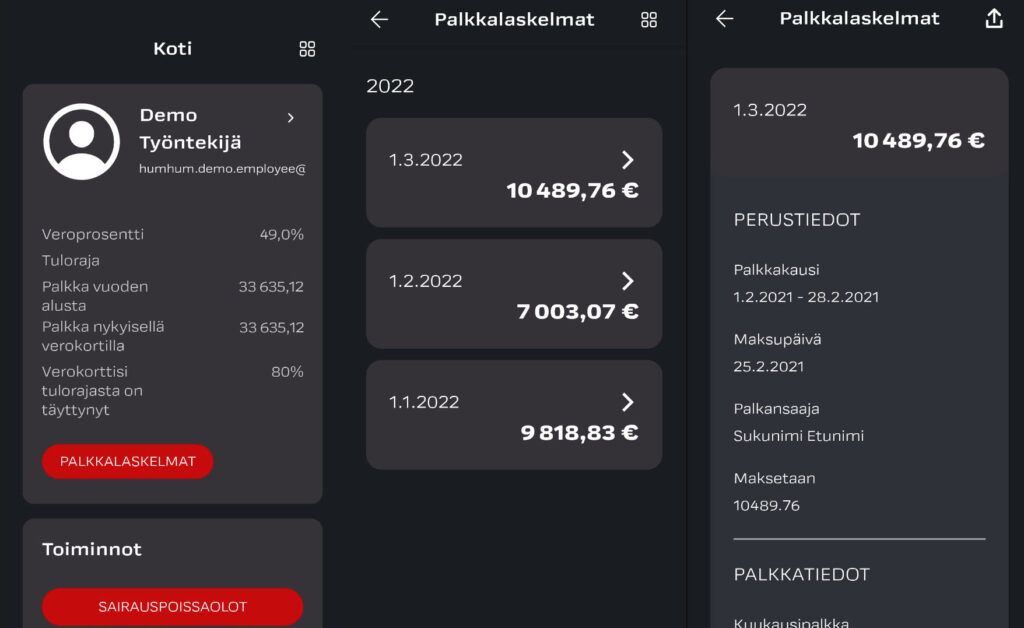

Where can I find payslips in my app?

You will find your own payslips easily form the home screen of the app under Payslips.

- You will also be shown the main information regarding your employment, for example: tax%, income limit, total income or holiday accumulation.

- This information can be shown if it can be deduced form your payslip. This is depends of you company payroll settings.

- Under the Payslips, you will find a listing of all your previous payslips, and you check them individually.

- Each payslip can be downloaded as a separate pdf-file.

Payslip reading instruction

- In the first section you will find basic information of the payroll period

- Payment date is the day when pay check was paid

- Total paid amount is shown here

- From this section you can check a listing of each pay type and deductions included to you paycheck

- All payments accumulated inside payroll period

- Yearly cumulative value of your paychecks

- Last year’s cumulative values of your paychecks

- You can check your latest saved tax percentage and income limit

You can check your personal employment details here:

- UserID

- Employment start date

- Banking info

- Job title

Details of your employment: monthly salary, hourly wage or part time percentage.

Your current available vacation days are shown here with possible part-time percentage and weekly hours.

Basic information regarding the employee

Salary slip notifications

When a new payslip is available for the user, an automatic notification is sent. Depending on the user’s notification settings, the notification will be delivered either as a push notification via the app or as an email.

The same message also includes a salary threshold alert if the app’s automation has detected the need for one.

Salary threshold alert

The salary threshold alert notified to the user takes into account the length of the pay period, taxable earnings, current period earnings, and the tax card’s income threshold. Based on this, it calculates how many similar periods it would take for the income threshold to be exceeded. If it appears that the threshold may be exceeded, a note is added to the new payslip notification.

- Alerts are programmed to be send starting from august of each year.

- In December, the alert is no longer sent because the tax year is already coming to an end.

- In January, the salary threshold alert is not in use at all.

Did not find what you were looking for?

You didn’t find solution from our knowledge bank? You can send a message to our customer service or get in touch with our specialists.